“Remittance” defined, and the power of digital money transfer platforms revealed

According to Merriam Webster, “remittance” is defined as a transmittal of money to a distant place like another country. This transmission of money may be done through traditional money management methods such as a bank or through modern solutions like a digital money transfer platform.

As we continue into the new year, the remittance market is expected to expand despite a slight decrease in the amount transferred due to the COVID-19 pandemic. In fact, in 2022, experts project remittances to grow at nearly 5%.

The power of a remittance

Whether for paying bills in a foreign country or supporting organizations abroad, a remittance may be sent for several reasons, but more often than not, money is sent to financially care for loved ones living internationally. For instance, over the past two-years, remittances were used as a lifeline to stay connected to loved ones during the pandemic when travel restrictions were implemented across the globe.

Moving forward, the act of transferring money to friends and family living abroad is anticipated to increase as businesses financially recover and people recuperate and plan for a financially healthier 2022.

What’s more, transferring money abroad has never been more convenient. Through digital methods, people are granted more transparency, visibility and power over when and how they want to send money. Remittances are especially beneficial in less developed countries where economic inequality has left many less-financially sound. As a result, remittances to low- and middle-income countries are projected to grow.

Why choose Paysend’s remittance platform

Paysend’s digital money transfer platform makes sending money home to a loved one:

- Easy. Instead of having to commute from your home to a bank, remittance outlet, etc. to then wait in line to speak to a cashier to transfer money, Paysend users can send money right from the palm of their hands anywhere, anytime.

- Fast. Transferring money through a bank may sometimes take more time due to slower processing times. With Paysend, transfers usually arrive to a recipient in close to real-time.

- Affordable. Paysend charges a flat fee of just $2 when transferring money internationally from the US.

Want an easy way to send a remittance to your friends or family living internationally? Download the Paysend Global Transfers app* from the App Store or Google Play today!

*Standard data rates from your wireless service provider may apply.

Latest Posts

Sending money to Poland isn’t just about transactions - it’s about staying connected with loved ones, supporting family, and helping celebrate life’s special moments. Whether it’s funding daily expenses, contributing to education, or lending a hand during festive occasions, the process should be fast, secure and hassle-free. With Paysend’s partnership with Visa, transferring money to Poland has never been easier.

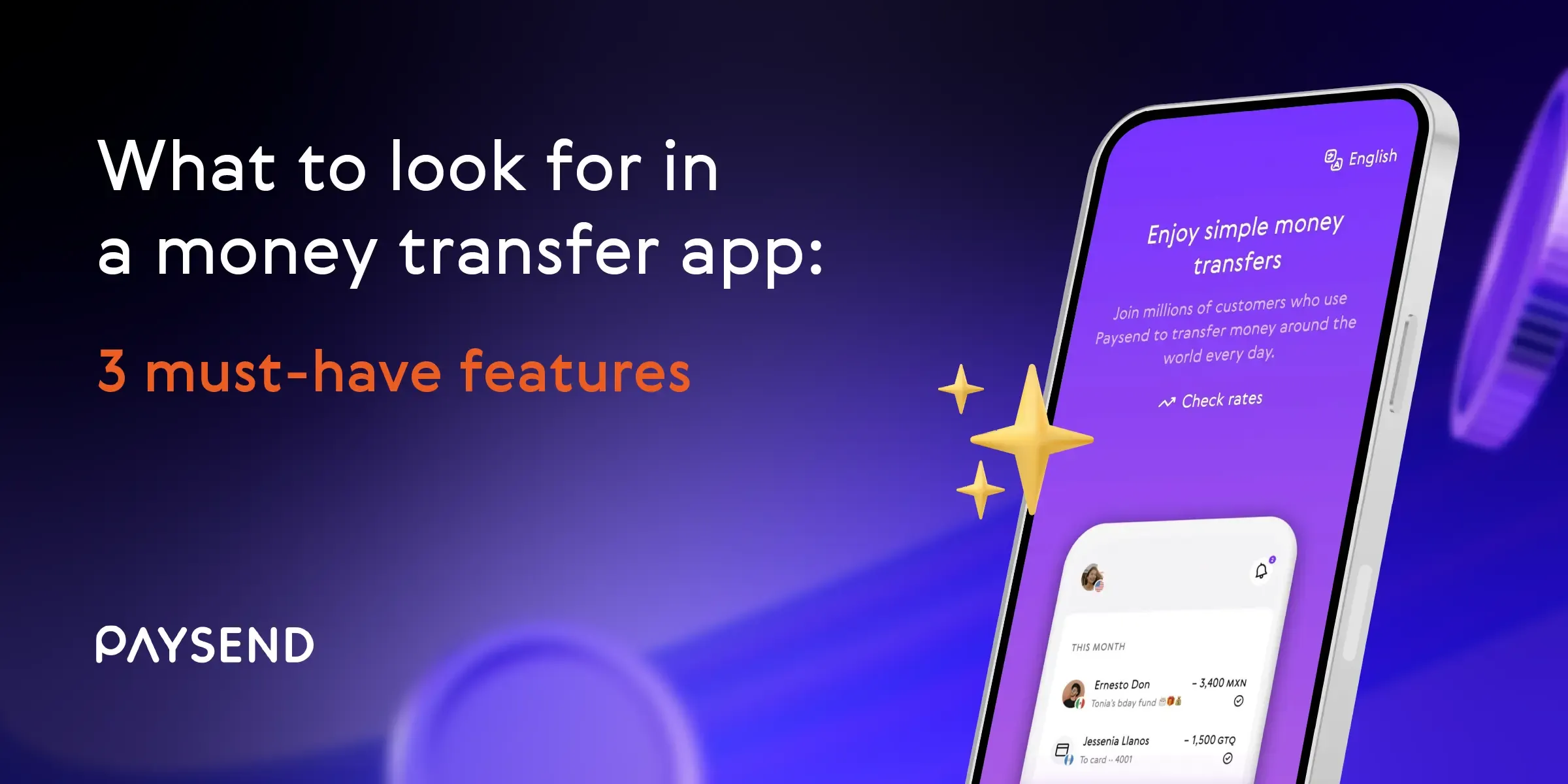

When it comes to international money transfers, choosing the right app can feel overwhelming. With so many options available, how do you know which one suits your needs? To make it simple, we’ve highlighted three must-have features to consider before making your first transfer. These tips will ensure your money reaches loved ones safely, affordably and without hassle.