We’ve partnered with Plaid to make our transfers even easier!

Here at Paysend we want to make it as simple as possible for you to add payment information and send money abroad.

Because let’s face it, nobody likes spending ages entering lots of long card numbers, and entering usernames and passwords when you’re directed to your banking app. We can all agree we’ve got much more interesting things to be getting on with.

Plaid is an open finance platform that helps people connect their bank accounts to digital finance apps and make payments from them. Connecting an account is the first step to using Paysend to credit an account and send money.

Both Paysend and Plaid believe payments should be seamless, and so we decided to join forces!

When adding your bank details in the Paysend app, you’ll be asked to authenticate this in your online banking app. Plaid speeds this up by automatically connecting your bank account to the Paysend app, meaning that you don’t have to enter your username and password to access your account. Once connected, you’ll be able to send money in seconds directly from your account, without searching for card or bank numbers.

Thanks to Plaid, our money transfers are much simpler and faster!

Head to the Paysend app or web platform to experience the power of Plaid and send money now!

Neueste Beiträge

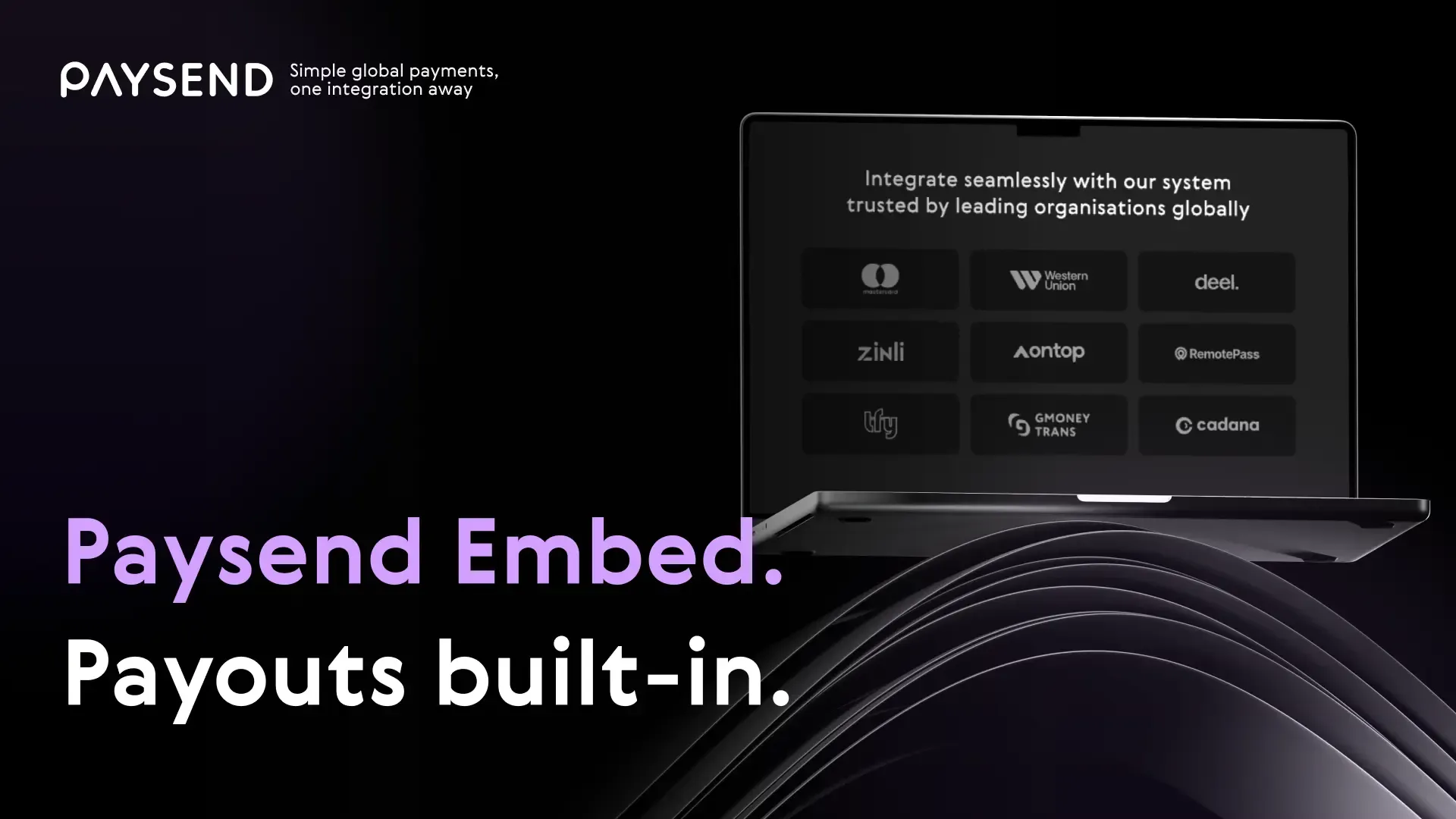

Behind every smooth international transaction is powerful infrastructure. With Paysend Embed, licensed institutions, fintechs, and digital platforms can integrate instant, compliant payouts into their apps, bringing their users closer to a truly borderless experience.

As part of Paysend’s mission to build the world’s largest digital payment network, Embed helps partners break barriers in cross-border money movement. It’s designed for teams that want to stay in control of their user experience, while Paysend powers the secure, compliant movement of funds behind the scenes.

As businesses expand internationally, managing global payments efficiently becomes a defining challenge. Collecting, converting, and disbursing funds across markets often involves multiple systems, delays, and high costs. Paysend’s Instant Settlement Accounts simplify this process, giving enterprises a single, multi-currency account that connects directly to our global payout network.

Designed to address the main pain points in cross-border money transfer, Instant Settlement Accounts help institutions manage liquidity, reduce FX risk, and access over 100 payout markets instantly. It’s part of Paysend’s mission to build the world’s largest digital payment network, empowering partners to move money globally with control, transparency, and precision.