How to settle in the UK as an immigrant

Moving to the UK can be an exciting yet overwhelming experience. Whether you’re drawn to London’s vibrant culture or the natural beauty of the Lake District, settling in a new country comes with challenges. At Paysend, we know how important it is to feel at home while staying connected with loved ones abroad, so we’ve put a practical guide to help you settle into life in the UK with confidence.

Finding a place to live

Finding accommodation is one of the first steps to settling down. Websites like Zoopla and Rightmove make it easy to browse rental properties in specific areas. You can filter results by budget, size and amenities to suit your needs.

If you’re looking to share accommodation, platforms like SpareRoom can connect you with potential housemates. Living with others can be a great way to save money and meet new people.

When renting in the UK, landlords usually require:

- Proof of identity (passport or ID card)

- Proof of income or bank statements

- A deposit and one month’s rent in advance

Setting up a bank account

Opening a UK bank account is essential for receiving salaries and avoiding international transaction fees. Choose from high-street banks like Barclays and NatWest, but when it comes to sending money home, it’s often much cheaper to use online money transfer apps and it’s important to know [what to look for when it comes to choosing which app to use.

To open an account, you’ll typically need:

- Proof of identity, such as a passport or biometric residence permit

- Proof of address, like a utility bill or tenancy agreement

Digital banks often simplify the process, allowing you to set up an account through a mobile app without visiting a branch.

Finding a job

The UK has a thriving job market with opportunities in various sectors. Whether you’re looking for work in healthcare, construction or digital marketing, platforms like Indeed, LinkedIn and the government’s Find a Job site are great starting points. Make sure to update your CV to UK standards and consider creating a LinkedIn profile to network with professionals in your industry.

If you’re moving to the UK from abroad, you may need a work visa before applying for jobs. The visa process can seem complex, but understanding your options and the requirements will help you navigate it smoothly. Check out our guide on How to Get a Work Visa in the UK to learn about the different visa types, eligibility criteria and how to apply.

Exploring your new home

The UK offers a rich mix of history, culture and natural beauty. In London, iconic landmarks like Big Ben and the Tower of London are must-sees. For nature lovers, the Scottish Highlands and Cornwall’s beaches are breathtaking.

Use apps like Trainline to navigate the UK’s extensive train network, making it easy to explore cities and countryside.

Understanding British culture

The UK is a vibrant mix of cultures, traditions and lifestyles, shaped by its rich history and diverse communities. From local festivals and markets to international cuisines and art scenes, there’s always something new to explore.

Community life varies across the country, with shared spaces like parks, libraries and community centres often acting as hubs for social connection. Immersing yourself in local events, exploring neighbourhoods and connecting with people from different backgrounds can help you settle in and gain a deeper appreciation for life in the UK.

Sending money home

For many immigrants, staying connected with family back home includes providing financial support. Traditional methods like banks can be expensive and slow. That’s where Paysend comes in - making it easy for expats to send money home.

Why choose Paysend for international transfers?

- Low fixed fees: Send money for as little as £1

- Fast transfers: Most arrive within seconds!

- Secure transactions: Advanced encryption ensures your funds are safe.

- Global reach: Send money to over 170 countries.

Settling in the UK as an immigrant comes with its challenges, from finding a home to adjusting to a new way of life. While there’s a lot to think about, one thing you shouldn’t have to worry about is staying connected with loved ones financially. With Paysend, you can send money abroad quickly, securely, and at low cost — helping you support family and friends no matter where they are.

Download the Paysend app for free

Haven’t downloaded the app yet? Download Paysend for free:

Or, if you’re reading on a browser, you can create your account through our official website.

Latest Posts

At Paysend, we’re on a mission to bring simple money transfer to all, including people and communities who haven’t always had easy access to fast, fair money transfers. This December, we’re helping you save on your international transfers so more of your money reaches your loved ones. From 10–31 December 2025, Paysend is offering improved foreign exchange rates on all transfers above $1,000 USD.

Whether you’re supporting family abroad, paying bills or simply sending a treat, this is the perfect opportunity to make larger transfers using our online money transfer service, and get better value while we continue building the world’s largest digital payment network.

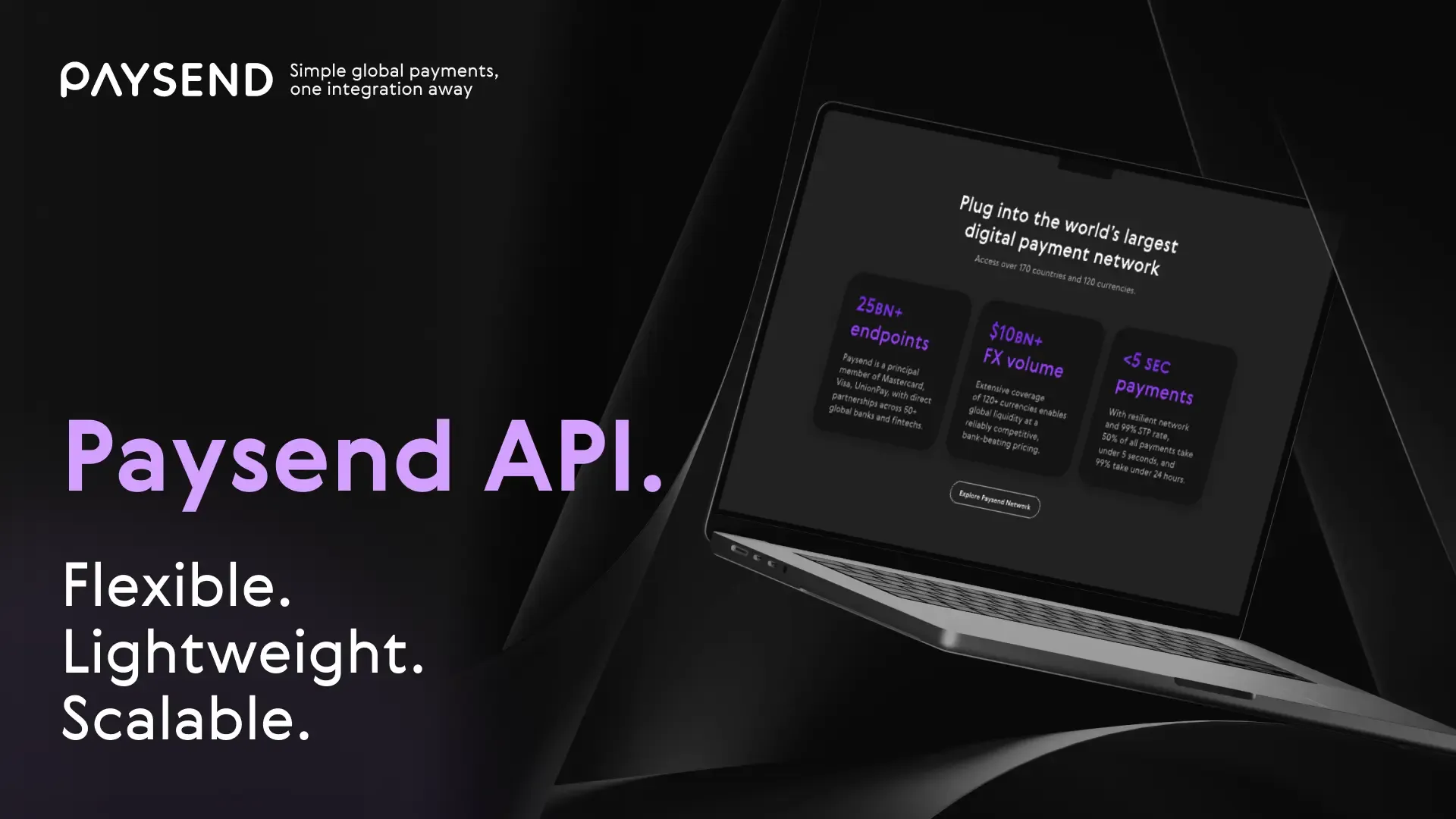

Cross-border money movement has evolved, and institutions now need infrastructure that can scale securely, integrate easily, and deliver value in real time. The Paysend Enterprise API provides that foundation, connecting licensed institutions, fintechs, payment facilitators, and platforms to a global payout network that reaches over 100 countries and supports more than 80 currencies.

Built as part of Paysend’s mission to build the world’s largest digital payment network, the Enterprise API helps partners break barriers in international payments. It allows them to move money with transparency, speed, and control, addressing the main pain points in cross-border transfer: fragmented systems, regulatory complexity, and slow delivery times.