How to get started with Paysend Business

In the rapidly evolving landscape of the digital marketplace, traditional business practices are becoming obsolete. With the world as your marketplace and clients scattered globally, you need a financial partner that matches your agility and adaptability. That’s where Paysend Business steps in, offering an innovative approach to your business.

Breaking the Mold of Traditional Banking

At Paysend Business, we understand the challenges businesses face when dealing with conventional banks. As an entrepreneur, sole trader or freelancer you need to pay and get paid with ease to keep growing your business. Paysend Instant Card Transfers are a game-changer in the world of banking. Breaking the mold of traditional delays, making transfer smoother and more efficient. No more waiting for days to access your funds or complete a transfer with complex IBAN details.

With Paysend Instant Card Transfers you just simply enter the name and card number of your recipient and click send. You can make transfers to Mastercard and Visa debit and credit cards globally, experiencing 0 delays with instant transfer times. Sending options are worldwide, allowing you to pay employees and contractors quickly and easily from Kazakhstan, Belarus, India, the United States, Singapore, Ukraine, and over 180 countries.

Simple Steps to Getting Started

Getting started with Paysend Business is remarkably straightforward. You can apply for your business account online by filling out an online application form. Provide us with basic personal details such as your name, address, and date of birth. For corporate accounts, we’ll require essential incorporation details, including your company’s registered name, incorporation number, and trading name. If needed, you might have to submit additional documents like an incorporation certificate or registry extract for your business account.

To verify your identity, we’ll need a few documents, such as a photo of your ID and a selfie. If you're not a director or shareholder, proof of authorization to open a business account will be necessary. Once you’ve completed the application, our team will review it. Most of the time, you can sit back and relax; however, we might reach out to you for additional information.

Seamless Transition to Paysend Business account

Moving your business to Paysend is effortless. No heavy lifting required—simply open your business account online and transfer funds into it to do contractors and suppliers payments. Get access to instant card transfers, multi-currency accounts and payments in one go with our bulk payments functionality, benefiting from competitive fees and with low FX rates. Also, you can set multi-user access to give your employees permissions to transact on your Paysend business accounts.

Approval and Verification

Wondering how long it takes to get approved? For eligible businesses, approval can happen in just a few hours. However, in some cases where additional documents are necessary, the process might take a bit longer. Once your free business account is active, you’ll have currency accounts in GBP, EUR, and USD with unique account details. You can also create multi-currency accounts in 32 currencies.

Empowering Your Business Journey

Once your Paysend business account is set up, you will have access to fast cross-border payments, you will be able to send and receive international payments; pay employees, contractors and suppliers overseas in over 180 countries and in 32 currencies and also get access to 14 domestic schemes internationally.

Get started today and unlock your global payments with Paysend Business.

Latest Posts

At Paysend, we’re on a mission to bring simple money transfer to all, including people and communities who haven’t always had easy access to fast, fair money transfers. This December, we’re helping you save on your international transfers so more of your money reaches your loved ones. From 10–31 December 2025, Paysend is offering improved foreign exchange rates on all transfers above $1,000 USD.

Whether you’re supporting family abroad, paying bills or simply sending a treat, this is the perfect opportunity to make larger transfers using our online money transfer service, and get better value while we continue building the world’s largest digital payment network.

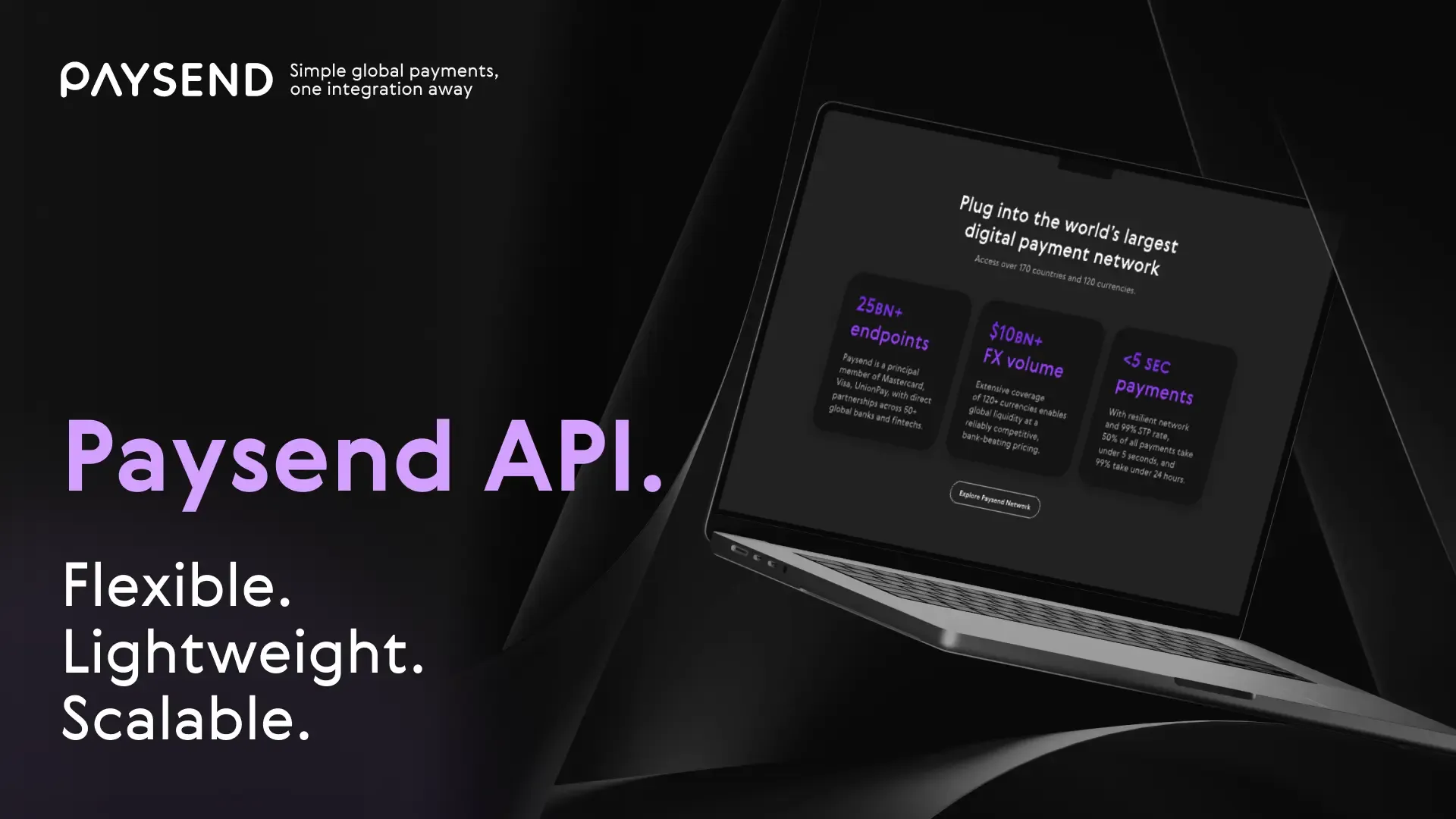

Cross-border money movement has evolved, and institutions now need infrastructure that can scale securely, integrate easily, and deliver value in real time. The Paysend Enterprise API provides that foundation, connecting licensed institutions, fintechs, payment facilitators, and platforms to a global payout network that reaches over 100 countries and supports more than 80 currencies.

Built as part of Paysend’s mission to build the world’s largest digital payment network, the Enterprise API helps partners break barriers in international payments. It allows them to move money with transparency, speed, and control, addressing the main pain points in cross-border transfer: fragmented systems, regulatory complexity, and slow delivery times.