Paysend vs Wise: The Real Cost of Sending Money Abroad

When choosing a method for sending money internationally, it’s essential to consider more than just the stated fees. Both explicit transaction fees and any additional costs embedded in the exchange rate or service markup affect how much your recipient gets, and together, they represent your true total cost.

How Money Transfer Fees Work

Every international money transfer involves:

- Transaction fees, which can be a fixed amount or a percentage of the transfer.

- Exchange rate markups, which are the difference between the real mid-market rate (the one you see on Google or Reuters) and the rate provided by the service.

Some services highlight ‘zero-fee’ transfers by incorporating part of their cost into the exchange rate. Others separate the fee and FX margin. Either way, what matters is the total amount the recipient receives.

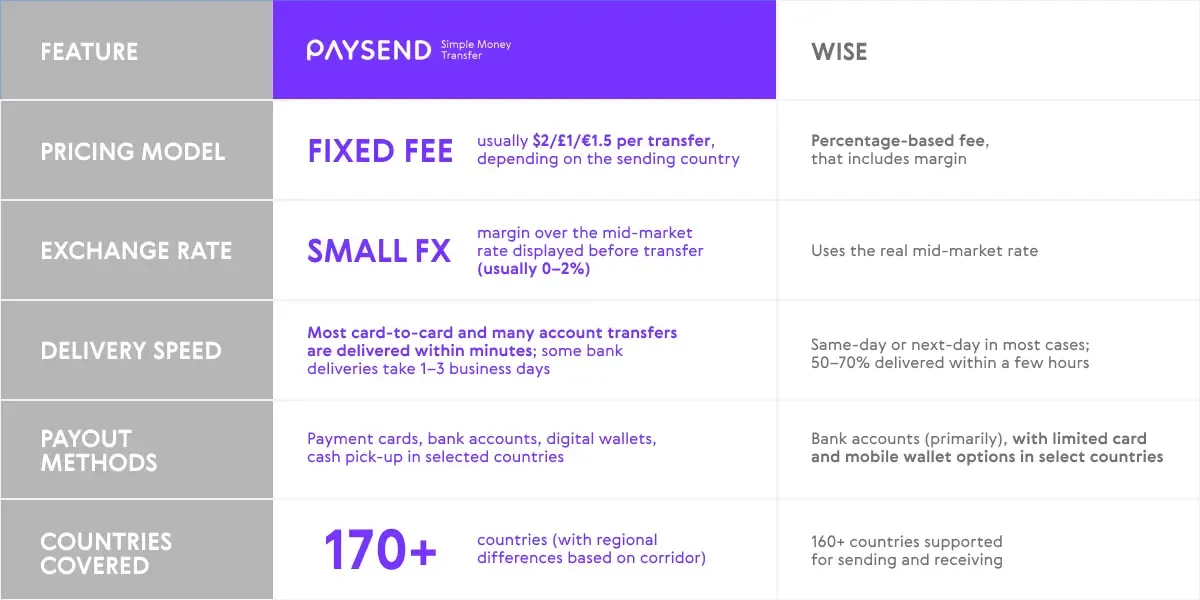

Paysend vs Wise: Key Differences

Paysend and Wise™️ are leading digital platforms for international payments—but their pricing approaches and features differ, as summarized below:

Data accuracy as of Nov 2025

Real Exchange Rates and Hidden Costs

The “mid-market” or real exchange rate is the midpoint between bank buy and sell rates, and is available on financial sites and currency converters. Most providers, including Paysend, includes a small FX margin, disclosed upfront before sending, while Wise applies the mid-market rate and a variable percentage fee, that includes margin.

Transparency and Speed

Both Paysend and Wise display all transfer costs and the estimated recipient amount before you send, ensuring no unpleasant surprises. Most Paysend transfers are almost instant, particularly for card-to-card payments, while bank transfers may take longer depending on the recipient’s local bank processing times. Wise also offers rapid delivery, with a majority of transfers arriving within one business day or less.

Which Service Is Better for You?

- Paysend is ideal if you want a simple, flat fee and instant delivery for card-based transfers, especially when sending larger amounts.

- Wise is a strong choice for those who prioritize mid-market exchange rates, transparent percentage-based fees, and broad payout coverage with bank recipients.

- For both services, always check the live rate and total recipient amount before sending, as availability and costs can vary by country and payment method.

Important Reminders

- First-time Paysend users often benefit from zero-fee intro offers and special rates, but regular transfers typically incur a small fixed fee and FX mark-up.

- Both services’ coverage and features evolve rapidly; always verify eligibility and costs directly through their official calculator prior to transfer.

- Delivery times may vary due to location, bank processes, or compliance checks.

For the most accurate and real-time quote, visit the official Paysend and Wise platforms. Use their calculators to verify costs, compare recipient payouts, and choose the best solution for your needs.

*Please note: While most transfers are now received within minutes, delivery times can still vary based on the recipient’s bank processing, compliance checks, or other local conditions.

The educational materials on this site are provided for informational purposes only and do not reflect the opinions of Central Bank of Kansas City, Member FDIC. Educational materials may contain links to content on third-party websites which are provided for your convenience; please note that linked sites may have a privacy and security policy different from our own, and we cannot attest to the accuracy of information. The Central Bank of Kansas City does not guarantee nor expressly endorse any particular business, product, service, or third-party content.

Disclaimer: All comparative statements are based on publicly available information from Paysend and Wise websites as of November 2025. Exchange rates, fees, and delivery times vary by corridor. WISE as a registered trademark owned by Wise Payments Limited in the UK. This article is for informational purposes only and does not imply partnership or endorsement.

Latest Posts

Cross-border payments now move trillions of dollars each day, connecting people and businesses across the globe. As international digital payments become more common, compliance and security matter more than ever. Customers expect not only speed, but also reliability and safety in every transaction.

Not long ago, sending money abroad meant standing in line, filling out forms, and hoping your recipient could collect the cash before the office closed. For decades, this was the reality of traditional money transfers, long waits, limited hours, and high fees.

Today, digital-first services like Paysend have changed that story completely. Money now moves in seconds, anytime and anywhere. This evolution isn’t just about technology; it’s about breaking barriers and addressing the main pain points in cross-border money transfer.