Top money transfer scams around the world

Sending money internationally has never been easier, but as digital payments become more popular, so do scams targeting unsuspecting senders. Fraudsters use various tactics to deceive people into transferring money, often pretending to be banks, employers, or even loved ones in distress.

To help you stay protected, we’ve outlined some of the most common and most recent money transfer scams happening around the world and how you can avoid them.

North America: Phishing Emails & Emergency Scams

On the rise in North America, phishing scams involve fake emails and texts pretending to be from your bank or a trusted company, urging you to take urgent action. These messages often contain links to fake websites designed to steal your login details.

Another common scam is the emergency scam, where fraudsters pose as a relative or friend in distress, claiming they need immediate financial help. They might say they’ve been in an accident, lost their wallet or need urgent bail money.

Tip: Always verify the sender’s identity before transferring money. Contact your bank directly if you receive an email or message about an account issue.

South America: Money Laundering & Recruitment Scams

Fraudsters in South America often lure victims with "job opportunities" that involve handling money transfers. They ask individuals to send or receive money on behalf of others — without realising they are laundering stolen funds.

How to stay safe: Never agree to move money for someone you don’t know. If a job sounds too good to be true, it probably is.

Europe: Overpayment & Fake Job Scams

In overpayment scams, scammers send money to victims, then claim they "accidentally" sent too much and request a partial refund. But after the victim sends money back, the original transaction is reversed, leaving them out of pocket.

Another common scheme in Europe is the fake job scam, where fraudsters post fake job listings that require applicants to pay a "training fee" or “visa processing charge.”

Tip: Legitimate employers never ask for money upfront. Avoid sending refunds for overpayments — wait for the funds to fully clear before taking action.

Africa: Lottery Scams & Advance-Fee Fraud

In Nigeria and other parts of Africa, lottery scams and advance-fee fraud remain common. Scammers claim you’ve won a big prize but need to pay a "processing fee" to receive it. Similarly, some fraudsters pretend to be officials promising inheritance payouts — if you just cover some minor costs first.

Tip: If you didn’t enter a lottery, you didn’t win. Never pay upfront fees for winnings or unexpected “inheritances.”

Asia: Investment Fraud & Crypto Scams

Scammers in Asia frequently target victims with fake investment opportunities. Promising "guaranteed high returns", fraudsters often lure people into Ponzi schemes or fraudulent cryptocurrency platforms, stealing funds once deposits are made.

Tip: Always research investment platforms before sending money. If returns sound too good to be true, they probably are.

Australia: Fake Charity & Donation Scams

Fake charity scams are particularly common in Australia, especially after natural disasters. Scammers pose as aid organisations, soliciting donations that never reach the intended cause.

Tip: Only donate through verified charities. Check official websites before sending money.

How to protect yourself from money transfer scams

No matter where you are in the world, these scams can strike when you least expect them. Here are some golden rules to keep your money safe:

- Only send money to people you know and trust.

- Be cautious of urgent or emotional requests. Scammers create a sense of panic to make you act fast.

- Verify sources before making a payment. Contact your bank, employer or the organisation directly.

- Use secure and trusted money transfer platforms like Paysend. Paysend uses advanced encryption bank-level security to keep your transactions safe.

Stay safe. Stay smart. Use Paysend.

If you ever come across a suspicious request, don’t send money until you verify its legitimacy. At Paysend, we’re committed to secure, fast and reliable money transfers — helping you stay connected without the risks. Haven’t downloaded the app yet? Download Paysend for free:

Or, if you’re reading on a browser, you can create your account through our official website.

Latest Posts

At Paysend, we’re on a mission to bring simple money transfer to all, including people and communities who haven’t always had easy access to fast, fair money transfers. This December, we’re helping you save on your international transfers so more of your money reaches your loved ones. From 10–31 December 2025, Paysend is offering improved foreign exchange rates on all transfers above $1,000 USD.

Whether you’re supporting family abroad, paying bills or simply sending a treat, this is the perfect opportunity to make larger transfers using our online money transfer service, and get better value while we continue building the world’s largest digital payment network.

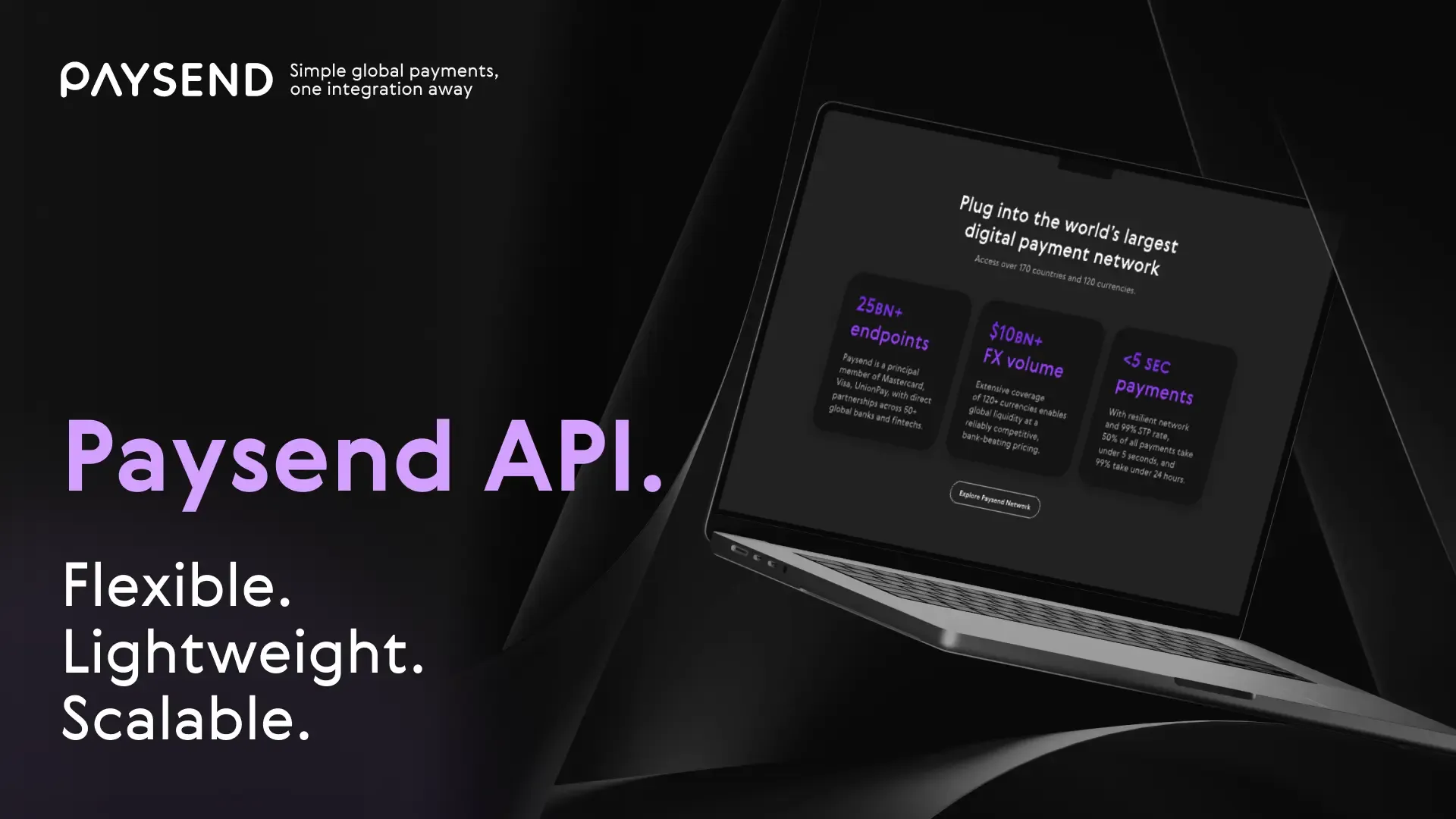

Cross-border money movement has evolved, and institutions now need infrastructure that can scale securely, integrate easily, and deliver value in real time. The Paysend Enterprise API provides that foundation, connecting licensed institutions, fintechs, payment facilitators, and platforms to a global payout network that reaches over 100 countries and supports more than 80 currencies.

Built as part of Paysend’s mission to build the world’s largest digital payment network, the Enterprise API helps partners break barriers in international payments. It allows them to move money with transparency, speed, and control, addressing the main pain points in cross-border transfer: fragmented systems, regulatory complexity, and slow delivery times.