The International Day of Family Remittances

The International Day of Family Remittances (IDFR) is celebrated every year on 16 June.

A family remittance is the money sent by migrant workers to support their families and loved ones back home.

According to the International Organization for Migration (IOM) there are 258 million international migrants globally (or 3.4% of the global population) who live outside their countries of birth.

They often send money back home to provide their families with health, nutrition, education opportunities. Remittances to low- and middle-income countries are expected to reach $550 billion in 2019, according to the World Bank’s latest Migration and Development Brief.

Remittance companies

Banks continue to handle the majority of remittances. However in recent years online money services and fintech companies are emerging as mobile technologies make it easier and faster to send money worldwide and allow to reduce the costs.

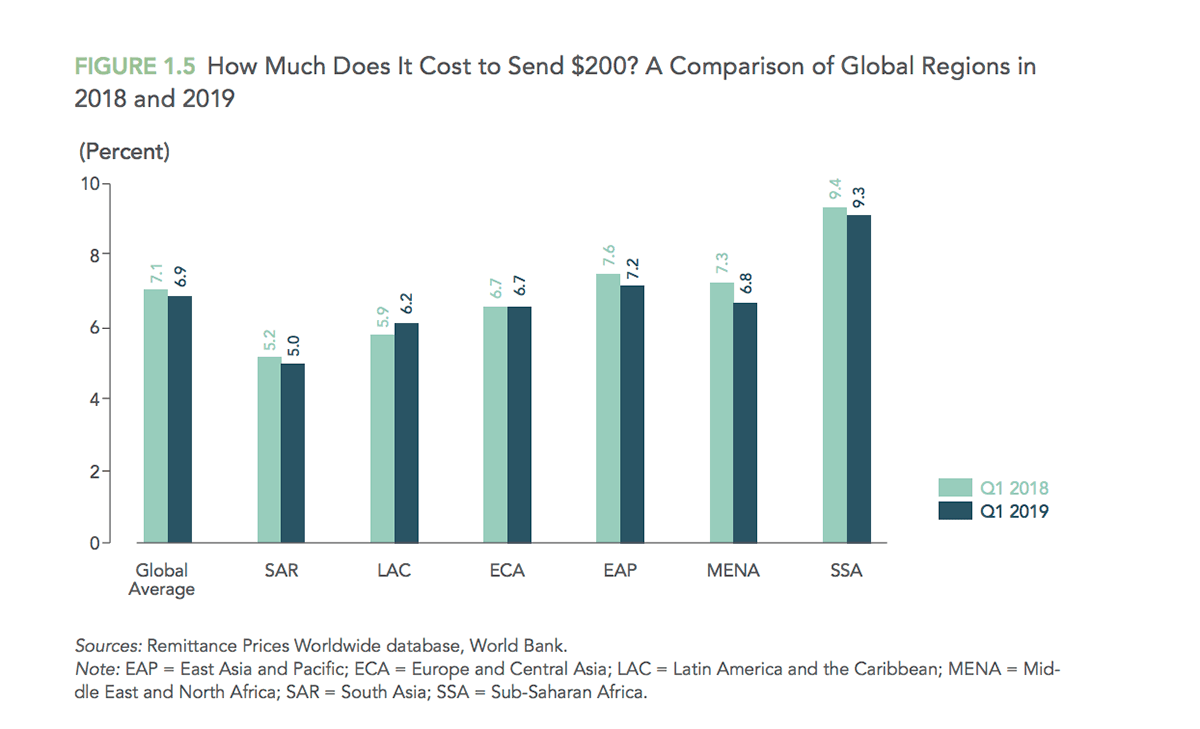

But despite the changes, costs remain very high. According to the World Bank’s Remittance Prices Worldwide database in Q1 2019, the Global Average cost for sending $200 remained at 7 percent, roughly the same level as in previous quarters (figure 1.5)

Banks are the most expensive remittance channels, charging an average fee of 10.2 percent in the first quarter of 2019. Post offices are the next most expensive, at over 7 percent.

In this case online money transfer services like Paysend can be the most convenient method of sending and receiving remittances.

Paysend, as the only global card-to-card money transfer network that currently operates in over 70 countries worldwide allow customers to transfer funds to any card overseas at a fixed price, using real exchange rate with no traditional fees.

For migrants and their families it’s time and cost-saving to send money with Paysend. Rather than spending a lot of time traveling to the bank, they can spend their time more effectively. With Paysend migrants can make a transfer from any location, at any time on the website or in the mobile app and check the total cost of sending. PaySend customers will also benefit from PaySend’s ability to send money at a fixed low price without any hidden fees or charges.

Online money services reduce security concerns associated with carrying cash

Using traditional methods, senders and recipients have to take the risk of carrying cash to or from the bank, making them susceptible to theft.

Sending and receiving remittances via Paysend allow to minimise these cash-handling risks.

At Paysend the recipients are able to see the incoming transfer and be able to immediately direct it to any Visa, MasterCard, UnionPay card or a bank account of their choice or withdraw cash at any ATM worldwide.

As part of the remittance industry, we are happy to support the observance of this day.

Here at Paysend we see on a daily basis just how vital that money is to individuals and families. We’re determined to make international money transfer cheaper, faster and simpler, and bring families closer together and help them stay connected across continents.

Thank you to all our customers who trust us with their hard-earned money to deliver it safely to their families.

Latest Posts

Money isn’t just currency - it’s a way to stay connected. Whether you’re helping family back home, supporting friends chasing their dreams, or just sending a surprise for a loved one, Paysend and Visa make it effortless to bridge the distance to Turkey, and transferring to an eligible Visa card via Paysend is one of the easiest ways to send money.

Sending money internationally has never been easier, but as digital payments become more popular, so do scams targeting unsuspecting senders. Fraudsters use various tactics to deceive people into transferring money, often pretending to be banks, employers, or even loved ones in distress.

To help you stay protected, we’ve outlined some of the most common and most recent money transfer scams happening around the world and how you can avoid them.