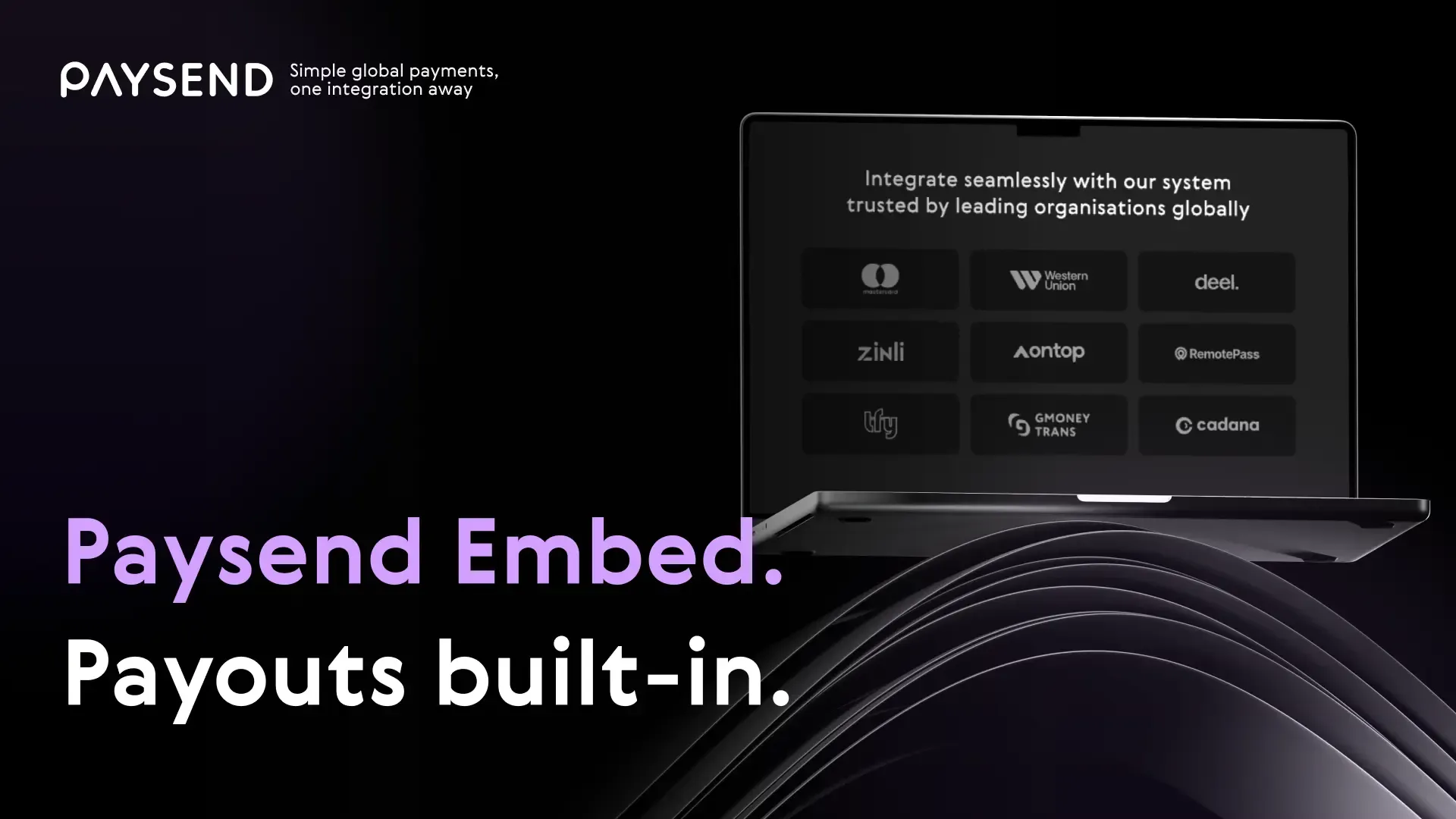

Paysend Embed: the widget powering seamless cross-border payouts

Behind every smooth international transaction is powerful infrastructure. With Paysend Embed, licensed institutions, fintechs, and digital platforms can integrate instant, compliant payouts into their apps, bringing their users closer to a truly borderless experience.

As part of Paysend’s mission to build the world’s largest digital payment network, Embed helps partners break barriers in cross-border money movement. It’s designed for teams that want to stay in control of their user experience, while Paysend powers the secure, compliant movement of funds behind the scenes.

Built for licensed institutions

For banks, regulated financial institutions, and licensed entities, Embed offers a white-label-ready widget that fits seamlessly into existing digital ecosystems. You maintain full control of your customer experience while Paysend handles global delivery, compliance, and infrastructure.

Key features:

- Native widget for app and web integration

- Tier 1 licensing and infrastructure

- Fast go-to-market

- Enterprise-level scalability

Built for fintechs

For startups and scaleups ready to expand across borders, Embed accelerates growth. With one integration, fintechs can embed international payouts directly into their products, unlocking new functionality, new markets, and new revenue streams in days, not months.

Key features:

- Fully embeddable widget

- Access to 100+ global corridors

- Licensed and compliant rails

- Rapid deployment

Built for the creator and gig economy

Modern platforms are global by default, and their users expect to get paid the same way. Embed empowers gig and creator platforms to deliver real-time* payouts inside their own ecosystems, giving freelancers, creators, and contractors faster access to their earnings.

Key features:

- Multi-currency, multi-market support

- Mobile-first widget integration

- Real-time payouts to card, wallet, or bank

- Scalable for high-volume businesses

Breaking barriers in global payouts

Paysend Embed addresses the biggest pain points in cross-border money transfer – compliance, licensing, and infrastructure – so partners can focus on innovation. It’s part of our mission to bring simple, secure money transfer to all, including the underserved, while giving businesses the tools to scale globally with confidence.

*Please note: Your money will be sent in real time; however, transfer delivery times may vary based on recipient bank processing, compliance checks, or other factors.

Ultimele postări

Sending money to Cambodia from Europe or the UK should be simple, fast and transparent. Whether you’re supporting family, paying for services, or managing expenses abroad, choosing the right delivery method makes all the difference.

With Paysend, customers across the EU and the UK can send money to Cambodia securely and conveniently using a range of delivery options designed to suit different needs. In this guide, we’ll explain all available delivery methods, with a special focus on bank transfers and Wing Bank, a trusted financial institution that makes receiving money convenient and accessible for families across Cambodia.

The holidays might be over but the celebration continues — we’ve now credited the prizes for our December Giveaways. But at Paysend, giveaways are not just about winning, they are about recognising the real people behind every transfer, and the reasons why sending money matters.

One of our December winners shared this with us:

“I am currently in the Czech Republic and thanks to Paysend I can send money to my parents who live in Ukraine and are finding it difficult to earn money in the current conditions.”

Stories like this remind us why Paysend exists. Behind every transfer is someone supporting family across borders, often during challenging times. Being able to send money easily, securely, and without unnecessary fees can make a real difference.