Simplifying Money Transfers: Send Money to Eligible Visa Debit Cards with Paysend

In today's fast-paced world, sending money quickly and securely to loved ones is essential. Paysend makes this process easy, fast, and convenient, allowing you to send money directly to a debit card with just a few clicks.

How to start sending money with Paysend?

If you are new to Paysend, before you can send money to Eligible Visa Debit Cards, you will have two options to create a new account and get started:

- Website: paysend.com

- Mobile App*: available from the App Store and Google Play

Then, follow the below 5 steps to sign up your Paysend account:

- Click the ‘sign up’ button and type in your phone number (including country code)

- Verify your account using SMS code, and create a 4-digit password for additional security on the app

- Enter your name, email and birth date

- Select the country you are currently in as your country of residence

- Enter your residential address to complete the set up

Look at how easy it is! It only takes a few minutes to register, and then you can send money to an eligible Visa Debit card in 3 easy steps:

- Select the country you want to send money to

- Input the recipients’ information: Name and 16 digits card number (and don’t worry their account information is kept safe.)

- Lastly, enter the details of how you want to pay for the transfer and that’s all! Your money will be on its way in minutes.

The best part is that your recipient doesn’t have to leave their house to pick up the money as it goes directly to their bank account in minutes avoiding the dangers of picking up cash from an in-person location.

For more information on how to send to a Visa Debit card, watch this video.

Why Choose Paysend?

Sending money to a Visa debit card with Paysend is not only straightforward but also comes with a host of benefits. Paysend offers the speed, security, and convenience you need.

Secure and Reliable: Paysend takes security seriously, employing robust encryption and fraud prevention measures to protect your financial information.

Low fees and competitive exchange rates: With transparent, affordable fees and competitive rates, you'll know exactly how much your transfer will cost. No hidden surprises!

Convenient: with Paysend you can send money to over 170 countries, 24 hours a day, 7 days a week via the app or online.

24/7 Support: Should you encounter any issues or have questions, Paysend's customer support team is available around the clock to assist you.

Which countries does Paysend support?

We currently support sending money to over 170 countries worldwide.

How long does it take to transfer money from Paysend to an Eligible Visa Debit card?

Paysend transfers to an Eligible Visa Debit card are usually processed and delivered to the recipient’s account close to real-time¹ on the same day. However, it can potentially take up to 3 business days for incoming money transfers, which depends on the currency and chosen delivery method.

If funds are not received by the recipient after 3 business days, please contact our customer support via chat at paysend.com or by email [email protected]

Global 24/7 support is available.

*Standard data rates from your wireless service provide may apply.

¹ Actual fund availability depends on the receiving financial institution and region.

Последние посты

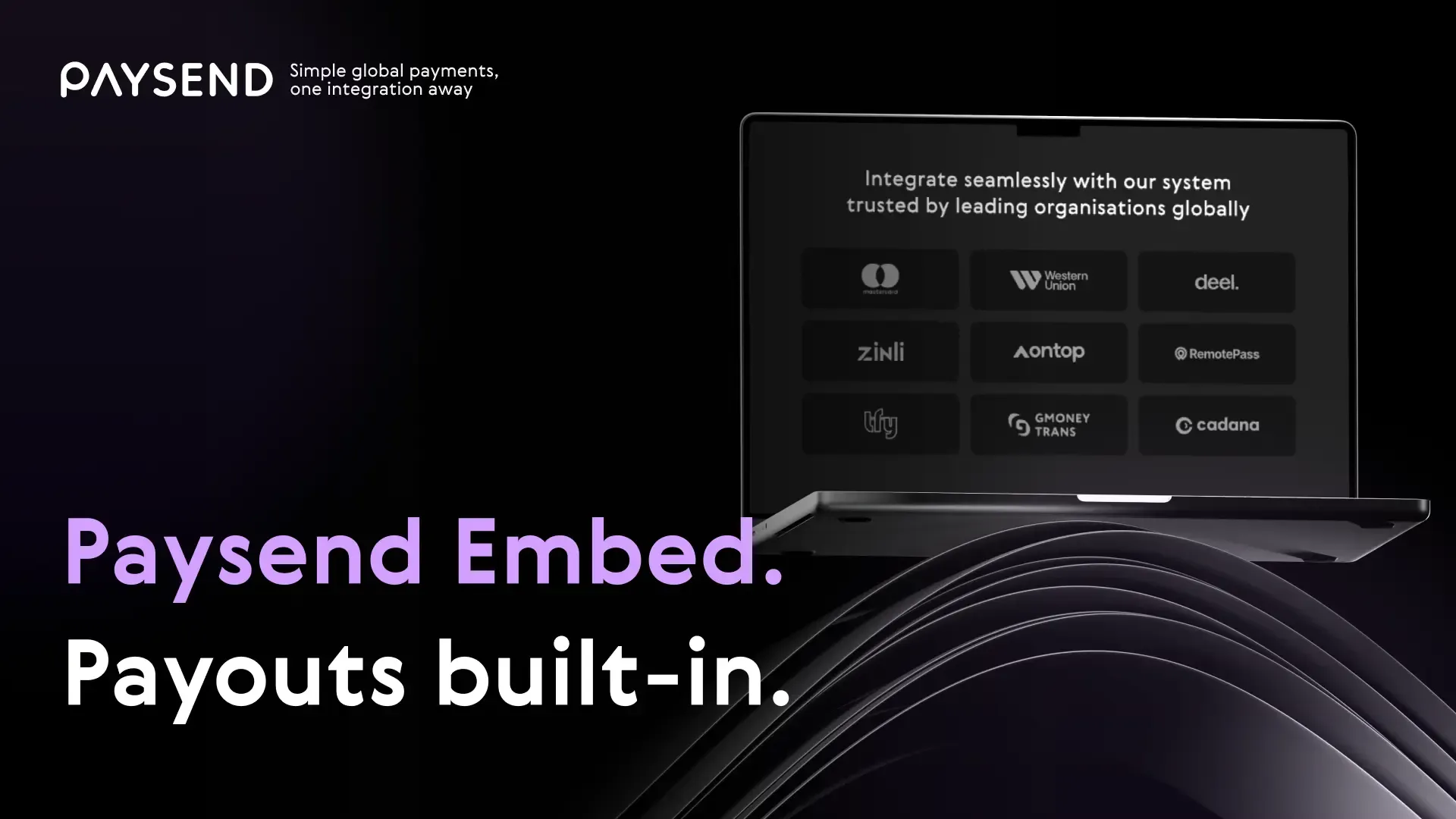

Behind every smooth international transaction is powerful infrastructure. With Paysend Embed, licensed institutions, fintechs, and digital platforms can integrate instant, compliant payouts into their apps, bringing their users closer to a truly borderless experience.

As part of Paysend’s mission to build the world’s largest digital payment network, Embed helps partners break barriers in cross-border money movement. It’s designed for teams that want to stay in control of their user experience, while Paysend powers the secure, compliant movement of funds behind the scenes.

2025 was a milestone year for Paysend — a year defined by scale, innovation, and the incredible stories of the people and businesses who trust us to move money across borders.

This year we saw global payouts reach new highs, expanded our corridors, partnered with game-changing platforms, and helped more people send money home instantly and affordably.

But behind the numbers are human stories — the real heartbeat of Paysend.