How to send money with Paysend: Money transfers Made Simple

Sending money to family and friends around the world has become a normal part of life, making it now more important than ever to have a coinvent and reliable way to support your loved ones no matter how far they are.

Why Choose Paysend?

1. Secure and Reliable: Paysend prioritizes the security of your information and uses advanced encryption technology to protect your data.

2. Competitive Rates: Paysend offers competitive exchange rates, so you get more value for your money.

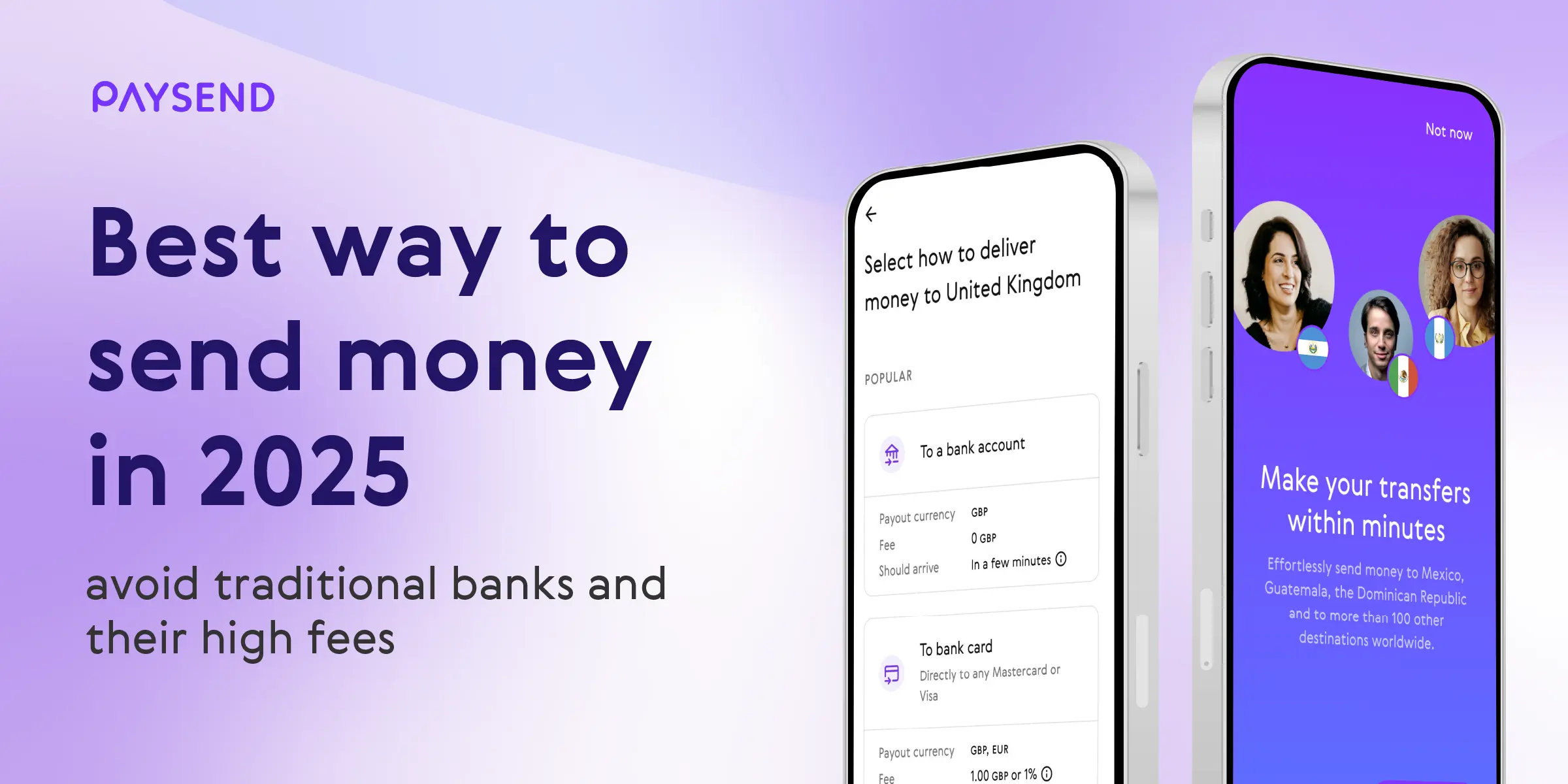

3. Convenient: with Paysend you can send money to over 100 countries, 24 hours a day, 7 days a week via the app or online.

4. Paysend is easy to use. It only takes a few minutes to register on the app or website, once you register, you can send money in a few easy steps.

- Step 1: Select send money, choose the country you want to send money to and enter the amount you wish to send.

- Step 2: Enter your recipient's details, then select how you want to transfer money and how much you want to send.

- Step 3: Click “confirm.”

That’s all, the money is on its way in minutes, and you avoid the hassle of having to wait in line at a money transfer location or be limited by restricted location times.

Join the millions of satisfied customers who trust Paysend for their international money transfers and experience the future of global finance today!

Download the app* and Try Paysend Today!

*Standard data rates from your wireless service provide may apply.

Останні дописи

Sending money to friends, family or business partners abroad should be quick, easy and affordable, right? But with traditional options - like trips to the bank, postal services or even outdated apps - it can feel like an uphill battle with high fees, delays and endless forms.

You’re probably wondering what the best app to transfer money internationally is. Well, that's where Paysend comes in. We’re here to make international money transfers fast, secure and easy.

As the Year of the Snake approaches, it’s time to celebrate Chinese New Year - a time for joy, family reunions and cherished traditions. For many, the Lunar New Year is also an opportunity to show love and support to family and friends, no matter where they are in the world. And Paysend is here to make it easier to stay connected by providing fast, secure and easy ways to send money to China.