Why do expats send money to Visa® Debit Cards in Kyrgyzstan?

For expats supporting loved ones in Kyrgyzstan, sending directly to a Visa debit card is one of the fastest, safest options. With Paysend, you can make secure, affordable transfers in just a few taps – helping friends or family access funds instantly*, wherever they are in Kyrgyzstan.

*Your money will be sent in real time; however, transfer delivery times may vary based on recipient bank processing, compliance checks, or other factors.

Why expats choose Visa debit cards in Kyrgyzstan

1. Fast delivery, often in minutes

When you send money online to Kyrgyzstan with Paysend, transfers to Visa debit cards are usually delivered almost instantly. That speed matters when your loved ones need money urgently for bills, tuition fees, or everyday expenses.

2. Funds ready to spend immediately

With the money arriving directly on their Visa debit card, your recipient can shop in-store, pay online, or withdraw cash from an ATM without waiting. It’s a safer and more convenient alternative to cash pick-ups.

3. Wide acceptance across Kyrgyzstan

Visa debit cards are accepted in most shops, restaurants, and service providers nationwide. Your recipient can spend the funds everywhere Visa debit cards are accepted, giving them complete flexibility.

4. Secure transactions you can trust

Paysend works with Visa’s trusted payment network, adding bank-level encryption and fraud prevention to keep your transfer safe from start to finish.

How to send money to Kyrgyzstan with Paysend

Sending money to Kyrgyzstan with Paysend is quick and simple — all you need is your recipient’s full name and their 16-digit Visa debit card number.

- Download the Paysend app from the App Store or Google PlayTM, or go to paysend.com.

- Create your account in minutes.

- Select Kyrgyzstan as the destination.

- Enter your recipient’s details.

- Choose how you’ll pay and confirm the transfer.

The money will be on its way in just a few clicks — and your recipient can start using it almost immediately.

Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc., registered in the U.S. and other countries.

Google Play and the Google Play logo are trademarks of Google LLC.

Why choose Paysend for money transfers to Kyrgyzstan?

- Fast delivery – Transfers to Visa cards are sent with fast delivery.

- Low fees & great rates – Transparent pricing means you always know the cost.

- Convenience – Send money to Kyrgyzstan 24/7 from over 100 countries.

- Security – Bank-level protection for every transaction.

- No account needed for recipients – They need their Visa debit card.

Send money to Kyrgyzstan with Paysend today — fast, secure, and simple.

The educational materials on this site are provided for informational purposes only and do not reflect the opinions of Central Bank of Kansas City, Member FDIC. Educational materials may contain links to content on third-party websites, which are provided for your convenience; please note that linked sites may have a privacy and security policy different from our own, and we cannot attest to the accuracy of information. The Central Bank of Kansas City does not guarantee nor expressly endorse any particular business, product, service, or third-party content.

Останні дописи

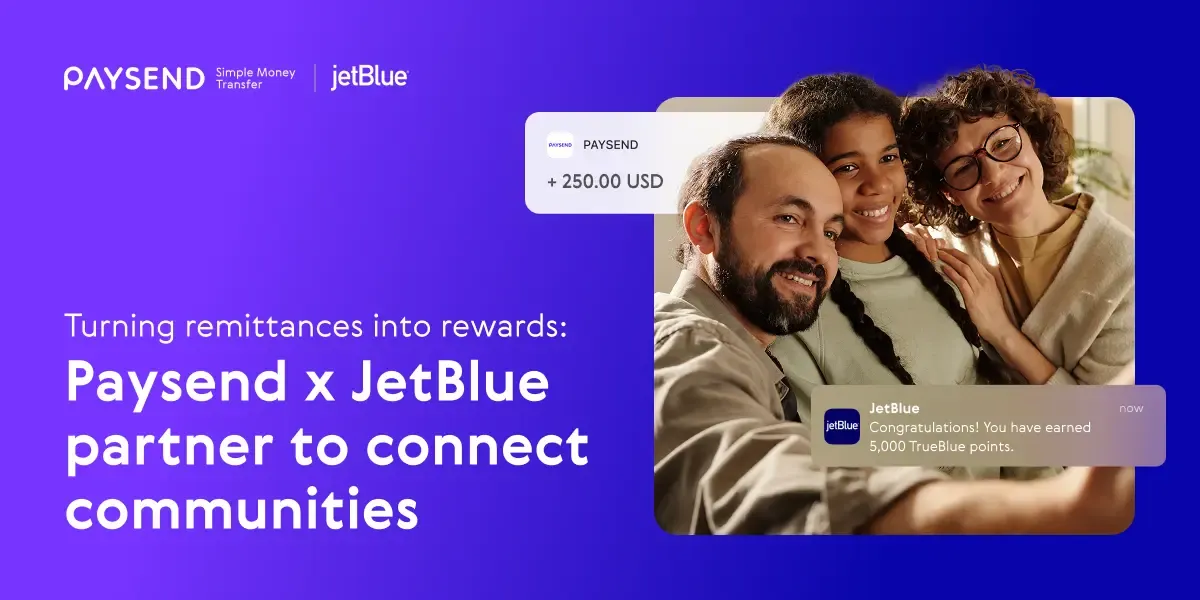

For millions of families across Latin America and the Caribbean, sending money home isn’t just about finances, it’s about connection. It’s how parents support children’s education, how siblings help one another through milestones, and how entire communities stay linked across borders.

At Paysend, we understand that these everyday remittances carry deep emotional and cultural meaning. That’s why our new partnership with JetBlue feels so special. Together, we’re connecting financial and travel experiences, giving customers the chance to earn TrueBlue points when they send money home to the Dominican Republic.

Now through March 30, 2026, customers in the United States who send a transfer of $100 or more to the Dominican Republic with Paysend will receive 5,000 TrueBlue points.* It’s a simple way to turn everyday remittances into travel rewards, helping families get one step closer to reuniting in person.

*For U.S. residents only. USD → USD transfers excluded. Offer valid through March 30, 2026. Limited to one (1) award of 5,000 TrueBlue points per customer. Paysend reserves the right to modify or cancel the promotion at any time. Third-party fees may apply. FX rates are determined by Paysend and may include a margin. Terms and conditions apply.

By Lisa Navarro, Head of Enterprise Operations at Paysend

In the world of cross-border payments, onboarding isn’t just a procedural step — it’s the foundation of a successful partnership. At Paysend Enterprise, our clients trust us with their most valuable asset: their ability to move money globally, securely, and efficiently. For me, that trust starts with how I bring them into our ecosystem.

As Head of Enterprise Operations, I see every onboarding journey — which we’re proud to typically complete in an impressive 2 weeks — as an opportunity to set the tone for the relationship, where operational excellence and true collaboration come together. I take this part of the process personally, because it’s where operational excellence and true collaboration first come together.