How to send money with the Post Office

The Post Office has long been one of the UK’s most trusted institutions – offering postal services, banking and money transfer options through both its physical branches and digital platforms.

But in 2025, the way people send money abroad has changed dramatically. With global families, digital adoption, and cost pressures reshaping the international transfer market, UK customers now have more choices than ever, from traditional services like the Post Office to fast, low-cost digital alternatives such as Paysend.

This guide explains how Post Office money transfers work today, what’s changed since 2020, and how it compares to modern digital money transfer services so you can choose what’s best for you.

Why People Use the Post Office for Money Transfers

The Post Office remains popular for one simple reason: trust and accessibility.

Many people still prefer to visit a physical branch, where they can talk to a real person, pay with cash, and send money to friends or family abroad. The Post Office’s partnership with Western Union allows customers to choose between cash pick-up or bank deposit options across more than 200 countries.

It’s especially useful for:

- Non-digital users, or those who prefer in-person assistance.

- Cash-based transfers, where the recipient collects funds from a local Western Union agent.

- Rural or older customers who value the familiarity of Post Office branches.

What’s Changed Since 2020 in the UK and Beyond

The international money transfer landscape has evolved significantly since 2020.

- Digital adoption: Millions of UK users now prefer mobile or online transfers instead of visiting branches.

- Speed: Transfers that once took days can now arrive within minutes via card-to-card or bank-to-bank methods.

- Cost pressures: Traditional providers face competition from fintechs offering transparent exchange rates and lower fees.

- Regulations & security: Stronger data protection (GDPR), financial compliance (FCA rules), and anti-fraud standards have reshaped the industry.

Despite these changes, the Post Office remains relevant — but many users now expect faster, cheaper, and more convenient digital options.

Step-by-Step: How to Send Money via the Post Office Today

You can send money internationally through the Post Office in two ways:

1. In-branch transfer

- Visit your nearest Post Office branch.

- Complete a money transfer form with the recipient’s name, location, and desired delivery method (cash pick-up or bank deposit).

- Provide photo ID and payment (cash or card).

- The recipient can collect funds from a Western Union agent in their country.

2. Online via Post Office

- Go to the Post Office website and create an account or log in.

- Enter the transfer amount, recipient details, and delivery method.

- Pay using a debit or credit card.

- Funds are typically available for cash pick-up within minutes, or 1–3 business days for bank deposits, depending on destination.

Fees:

Transfer costs vary depending on the amount, delivery method, and exchange rate.

While advertised fees may seem low (from around £1.90), additional FX margins can affect the total received amount. Always check the final rate before confirming your transfer.

How the Post Office Stacks Up: Pros & Cons (2025 Update)

Here’s how the Post Office compares today based on speed, cost, and convenience.

Pros:

- Over 11,500 branches across the UK for in-person support.

- 350,000+ cash pick-up locations worldwide via Western Union.

- Ideal for non-digital users or those needing in-person verification.

- Can send to over 200 countries globally.

Cons:

- Higher overall costs due to exchange rate margins and transfer fees.

- Transfers to bank accounts can take up to 3 business days.

- Requires ID and form-filling in branch.

- Limited digital features compared to modern apps.

- No card-to-card option (requires bank details).

Modern Alternative: Why Consider Paysend (and Similar Digital Services)

If you prefer speed, transparency, and convenience, digital platforms like Paysend offer a modern way to send money abroad.

With Paysend, you can transfer money:

- Directly from your card to another card, bank account, or wallet, often in minutes.

- To over 170 countries globally.

- With a low fixed fee (£1, €1.5, or $2) or zero fees for selected routes.

- Using real-time exchange rates and instant delivery notifications.

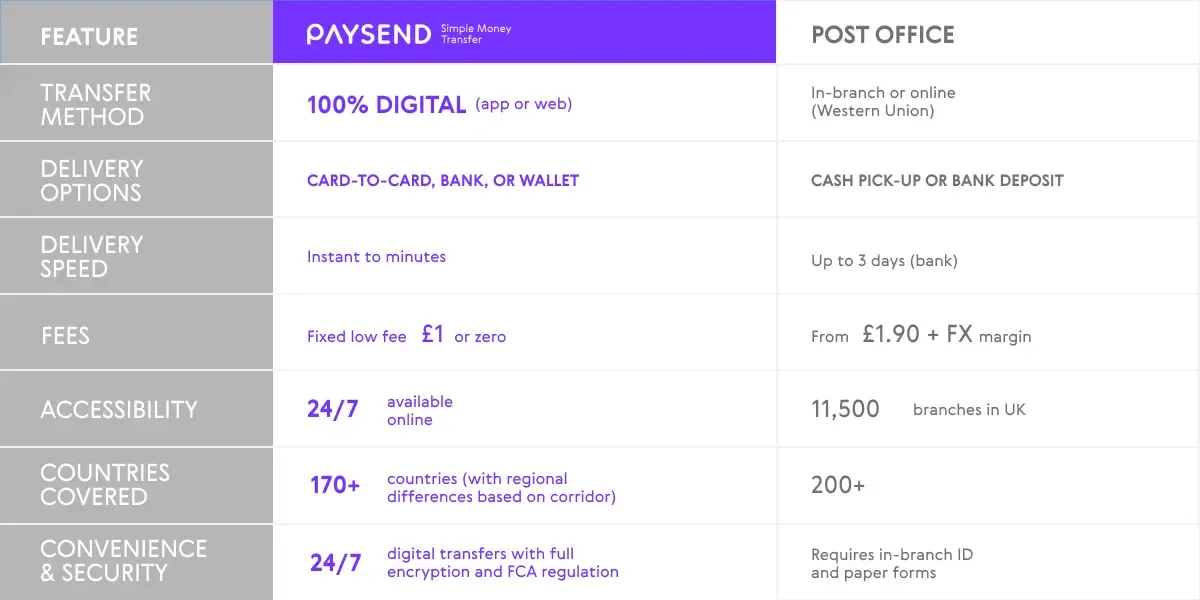

Post Office vs Paysend: At a Glance

With Paysend, you don’t need to queue, fill out forms, or wait days for delivery. Everything is handled securely through the app or website – all you need is the recipient’s name and card number.

How to Choose the Right Service for You

Before sending money abroad, consider what matters most:

- Cost: Compare total fees and exchange rates.

- Speed: How quickly will funds arrive?

- Delivery method: Card, bank account, or cash pick-up?

- Ease of use: Are you comfortable using apps or do you prefer in-person help?

- Security: Choose licensed and regulated providers.

Tip for UK expats and families:

If your recipient has a bank card, card-to-card transfers (like Paysend’s) are often the fastest and cheapest way to send money abroad.

Quick Summary

Before you send money, ask yourself:

- Do I have my recipient’s bank or card details?

- What fees and FX rates will I pay?

- How fast will the money arrive?

- Do I need to visit a branch?

In summary:

If you value in-person service, the Post Office remains a solid, trusted choice.

If you prefer speed, low fees, and digital convenience, Paysend may be the better fit.

Next steps? Compare your options before your next transfer. Use the Paysend money transfer calculator to see how much more your recipient could receive with low-cost, card-to-card transfers.

Eng soʻnggi xabarlar

Czechia is a country where tradition and modernity meet every day. From the cobbled streets of Prague’s Old Town to the bustling wine markets of Moravia, life here is increasingly digital — and that includes how people move and manage money.

For anyone supporting loved ones in Czechia, Visa card transfers with Paysend offer a secure, easy, and fast way to send funds that fit seamlessly into the Czech lifestyle.

Curious what it takes to bring a private chef into your home or lifestyle? Whether for a special occasion or ongoing service, the cost of hiring a chef varies widely depending on your needs. Here’s a clear breakdown of what to expect and how prices are set.