New customer offer: Zero fees* and Special Exchange rate on your first transfer

If you're new to Paysend, there’s never been a better time to try us. We’re offering new customers in the US a special welcome: no transfer fees and a Special Exchange Rate on your first money transfer — no promo code needed.

A smart way to send money

Looking for money transfer offers? Paysend makes your first money transfer online easy and rewarding:

- Zero transfer fees

- Special FX rate that helps your money go further

- No promo code required – the offer is applied automatically

- Send to 100+ countries via card, account or wallet

- Works for all currencies, all payout methods, all networks – including same-currency transfers like USD to USD and EUR to EUR.

Whether you’re supporting family, sending gifts, or covering expenses abroad, it’s a quick and low-cost way to get started.

Disclaimer: *New customers only. Offer valid from April 22, 2025, through January 15, 2026. One-time offer for first transfer only. FX rates are determined by Paysend and may include a margin. Third-party charges may still apply. Terms and Conditions apply.

How to transfer money internationally with Paysend

Wondering how to transfer money internationally from the US? It’s simple:

- Download the Paysend app or visit the Paysend website. There’s no cost to sign up.

- Create an account

- Select ‘Send money’

- Select your recipient country

- Enter recipient details - bank account or bank card

- Enter the amount you want to transfer

- Pick a payment method – bank account, debit/credit card, Digital Wallets

- Review the live exchange rate and fees (your first transfer will show Zero fee + Special Exchange rate)

- Send! Most transfers arrive in minutes, and your recipient doesn’t need a Paysend account

Exchange rates vary and are subject to change, so please check the Paysend app for real-time rates. Need to know how long an international money transfer takes? With Paysend, 95% of transfers are completed in seconds. We will send your money in real-time, but it could take up to three business days depending on your recipient's bank

Why Paysend?

If you're comparing how to send money internationally, here’s why Paysend stands out:

- Transparent pricing – no hidden fees

- Secure delivery – with 24/7 protection and support

- Trusted by 10+ million users worldwide

- Easy-to-use and intuitive app

- No codes. No catches. Just an exclusive customer offer to get you started.

Disclaimer: *New customers only. Offer valid from April 22, 2025, through January 15, 2026. One-time offer for first transfer only. FX rates are determined by Paysend and may include a margin. Third-party charges may still apply. Terms and Conditions apply.

Eng soʻnggi xabarlar

Hi, I’m Rick, and I lead Paysend Enterprise’s Commercial Team across North and South America.

If you’re a small or medium-sized business in the US, chances are you’ve looked south and seen the opportunity. Central and South America represent some of the fastest-growing e-commerce and digital economies in the world. But if you’ve ever tried to expand there, you know that payments are often the sticking point.

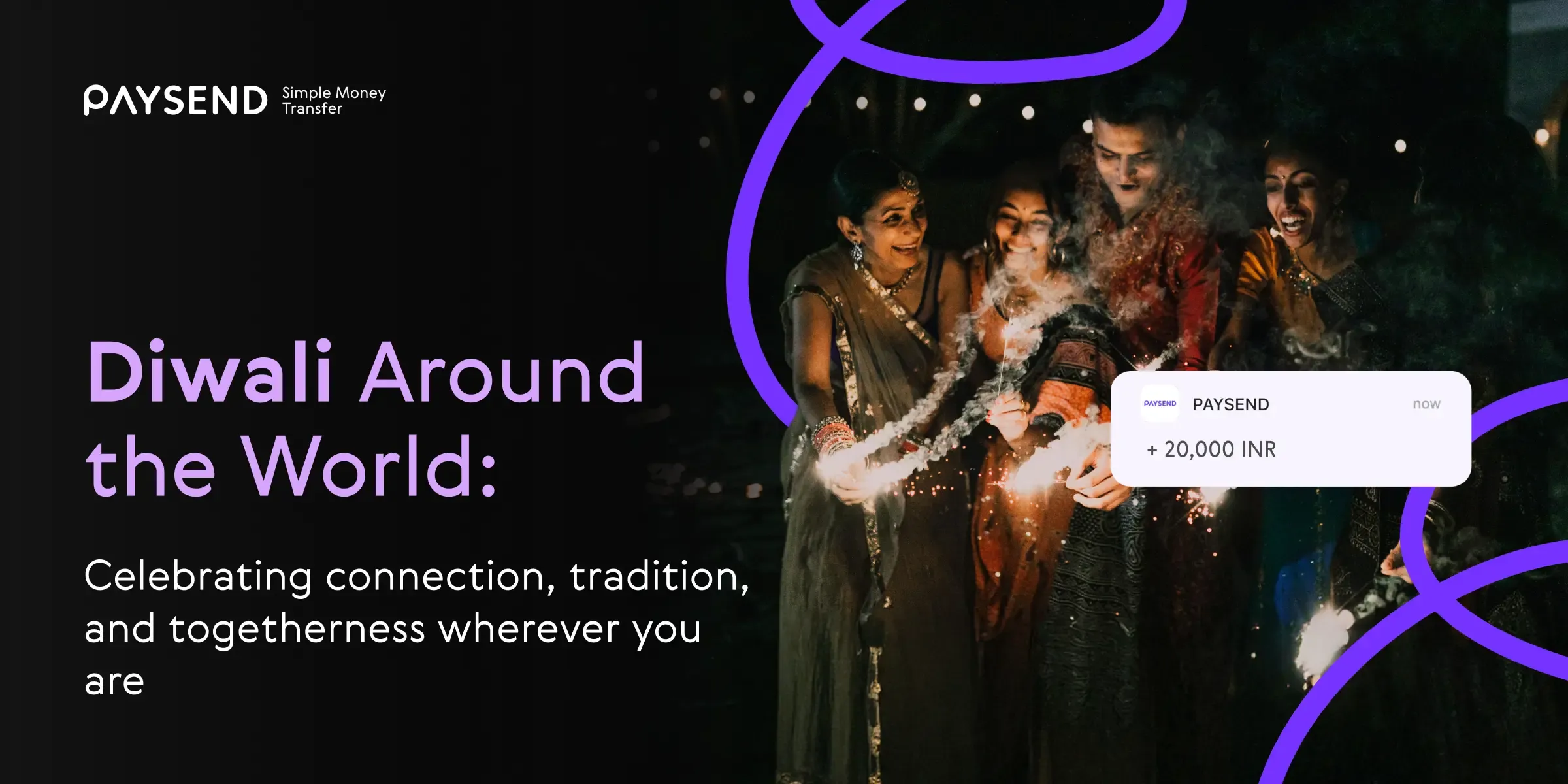

Every October, millions around the world celebrate Diwali, the Festival of Lights — a time for family, gratitude and new beginnings. For many living abroad, it’s also a moment to feel closer to home, even when oceans apart.