Case Study: Remozo – Scaling Global Freelancer Payroll with Paysend Enterprise

About Remozo

Remоzo (Apzone Ltd, Cyprus) is a global hiring & payroll platform. It helps companies to manage international talent through Contractor-of-Record (COR) and Employer-of-Record (EOR) solutions.

Remozo’s mission is to simplify cross-border work by enabling businesses to hire, onboard, manage, and pay contractors or full-time employees in over 190 countries.

Click here to learn more about Remozo’s capabilities.

The Need

As a fast-scaling EOR platform, Remozo needed a global payout solution that could:

- Deliver fast, reliable payments across multiple regions.

- Access hard-to-reach markets often underserved by traditional providers.

- Offer multiple payout options including direct-to-account and card-based payments.

- Scale with their international expansion and diverse freelancer base.

Existing providers were unable to deliver both the coverage and speed Remozo required, limiting their ability to differentiate and meet client needs.

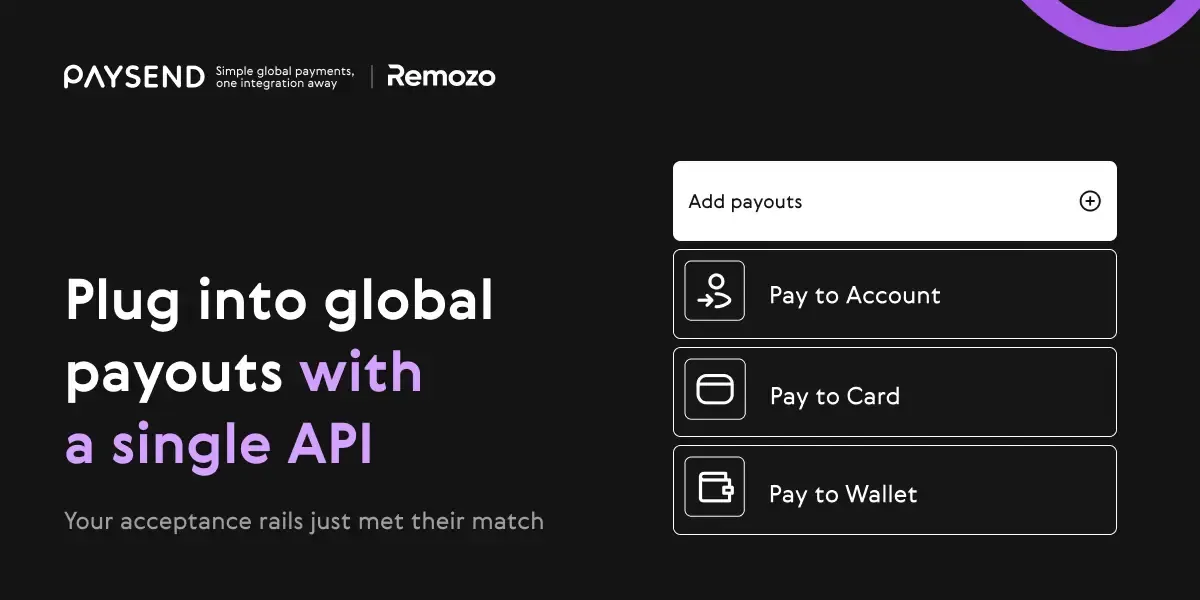

The Solution: Paysend Enterprise API

Remozo integrated the Paysend Enterprise API, gaining direct access to Paysend’s global payout network spanning 170 corridors and 80 currencies, powered by 48 regulatory licenses worldwide.

Through Paysend’s API, Remozo can offer its clients:

- Bank payouts – secure direct-to-account transfers in multiple currencies.

- Original Credit Transactions (OCT) card payouts – instant payments to Mastercard, Visa, and key local schemes including Uzcard (Uzbekistan), Korti Milli (Tajikistan), Humo (Uzbekistan), and Unionpay (China).

- Expanded coverage in underserved regions, providing a competitive edge in emerging markets.

The Outcome

Since launching with Paysend in July 2025, Remozo has achieved:

- Accelerated global coverage – unlocking access to regions competitors struggle to serve.

- Improved freelancer experience – faster, more stable payment options for global contractors.

- Rapid growth – transaction volumes and client adoption have grown significantly within the first months of integration.

- Market differentiation – positioning Remozo as a leading EOR platform for seamless international payroll.

- Significant growth – since launching with Paysend Remozo’s volumes have grown significantly showing steady month on month growth of over 100%.

Remozo Testimonial

"Partnering with Paysend has allowed us to expand our reach into regions where other providers couldn’t deliver. The flexibility of their API and access to both bank and card payouts has transformed the way we serve our global freelancer base."

— Anastasiya Zubritskaya, COO, Remozo

Paysend Testimonial

“At Paysend, our goal is to empower platforms like Remozo to unlock new markets and revenue opportunities through seamless global payouts. By integrating our API, Remozo can now reach regions that were previously underserved, providing faster, more reliable payment options to freelancers worldwide. Their rapid growth since launch is a great example of how our technology helps partners scale with confidence.”— Danny May, Enterprise Sales Leader, Paysend Enterprise.

Conclusion

By leveraging the Paysend Enterprise API, Remozo has been able to scale rapidly, enhance client satisfaction, and capture new market opportunities. This partnership demonstrates how Paysend enables Employer of Record platforms to unlock new markets, new revenues, and new ways to pay globally.

最新帖子

Cross-border payments now move trillions of dollars each day, connecting people and businesses across the globe. As international digital payments become more common, compliance and security matter more than ever. Customers expect not only speed, but also reliability and safety in every transaction.

Not long ago, sending money abroad meant standing in line, filling out forms, and hoping your recipient could collect the cash before the office closed. For decades, this was the reality of traditional money transfers, long waits, limited hours, and high fees.

Today, digital-first services like Paysend have changed that story completely. Money now moves in seconds, anytime and anywhere. This evolution isn’t just about technology; it’s about breaking barriers and addressing the main pain points in cross-border money transfer.