Paysend Instant Settlement Accounts: managing global money movement in real time

As businesses expand internationally, managing global payments efficiently becomes a defining challenge. Collecting, converting, and disbursing funds across markets often involves multiple systems, delays, and high costs. Paysend’s Instant Settlement Accounts simplify this process, giving enterprises a single, multi-currency account that connects directly to our global payout network.

Designed to address the main pain points in cross-border money transfer, Instant Settlement Accounts help institutions manage liquidity, reduce FX risk, and access over 100 payout markets instantly. It’s part of Paysend’s mission to build the world’s largest digital payment network, empowering partners to move money globally with control, transparency, and precision.

Built for payroll platforms

Global payroll operations depend on accuracy and timing. With Paysend’s Instant Settlement Account, payroll providers can collect, convert, and pay workers across multiple countries and currencies in real time — all from one platform. This removes friction from cross-border salary payments and ensures teams get paid on time, every time.

Key features:

- Multi-currency accounts (8 major currencies)

- FX swaps and conversion tools

- Direct access to 100+ payout markets

- Compliance and settlement tools

Built for e-commerce

For online marketplaces and platforms paying international sellers, fragmented settlement processes often slow growth. Paysend’s Instant Settlement Account unifies everything — collection, FX conversion, and disbursement — through one global account. Sellers can be paid quickly and transparently in their preferred currencies, and businesses gain full visibility of every transaction.

Key features:

- Collect in 8 currencies

- Competitive FX

- Near-instant global payouts

- Consolidated reporting and compliance

Built for travel

In the travel sector, where payments to global suppliers, partners, and customers happen around the clock, speed and control are critical. Paysend’s Instant Settlement Account allows travel businesses to manage funds across multiple currencies, streamline supplier payments, and reduce FX exposure, all in real time*.

Key features:

- Support for 8 currency wallets

- FX tools and risk mitigation

- Near-instant disbursement to global partners

- Full reporting and audit trail

Built for retail

Retail brands are increasingly global, relying on a wide network of suppliers and partners. Paysend’s Instant Settlement Account makes international disbursement simple and cost-efficient. Businesses can manage treasury, FX, and supplier payments in one place, without the complexity of multiple accounts or intermediaries.

Key features:

- Multi-currency collection

- Near-instant access to global payout rails

- Streamlined treasury and FX control

- Flexible account structure

Simplifying settlement, globally

Paysend Instant Settlement Accounts are built for businesses that need speed, simplicity, and control in managing international funds. By combining multi-currency management, real-time access, and full compliance, Paysend gives global enterprises a smarter way to operate, breaking barriers and making cross-border money movement as seamless as domestic payments.

*Please note: Your money will be sent in real time; however, transfer delivery times may vary based on recipient bank processing, compliance checks, or other factors.

Latest Posts

As businesses expand internationally, managing global payments efficiently becomes a defining challenge. Collecting, converting, and disbursing funds across markets often involves multiple systems, delays, and high costs. Paysend’s Instant Settlement Accounts simplify this process, giving enterprises a single, multi-currency account that connects directly to our global payout network.

Designed to address the main pain points in cross-border money transfer, Instant Settlement Accounts help institutions manage liquidity, reduce FX risk, and access over 100 payout markets instantly. It’s part of Paysend’s mission to build the world’s largest digital payment network, empowering partners to move money globally with control, transparency, and precision.

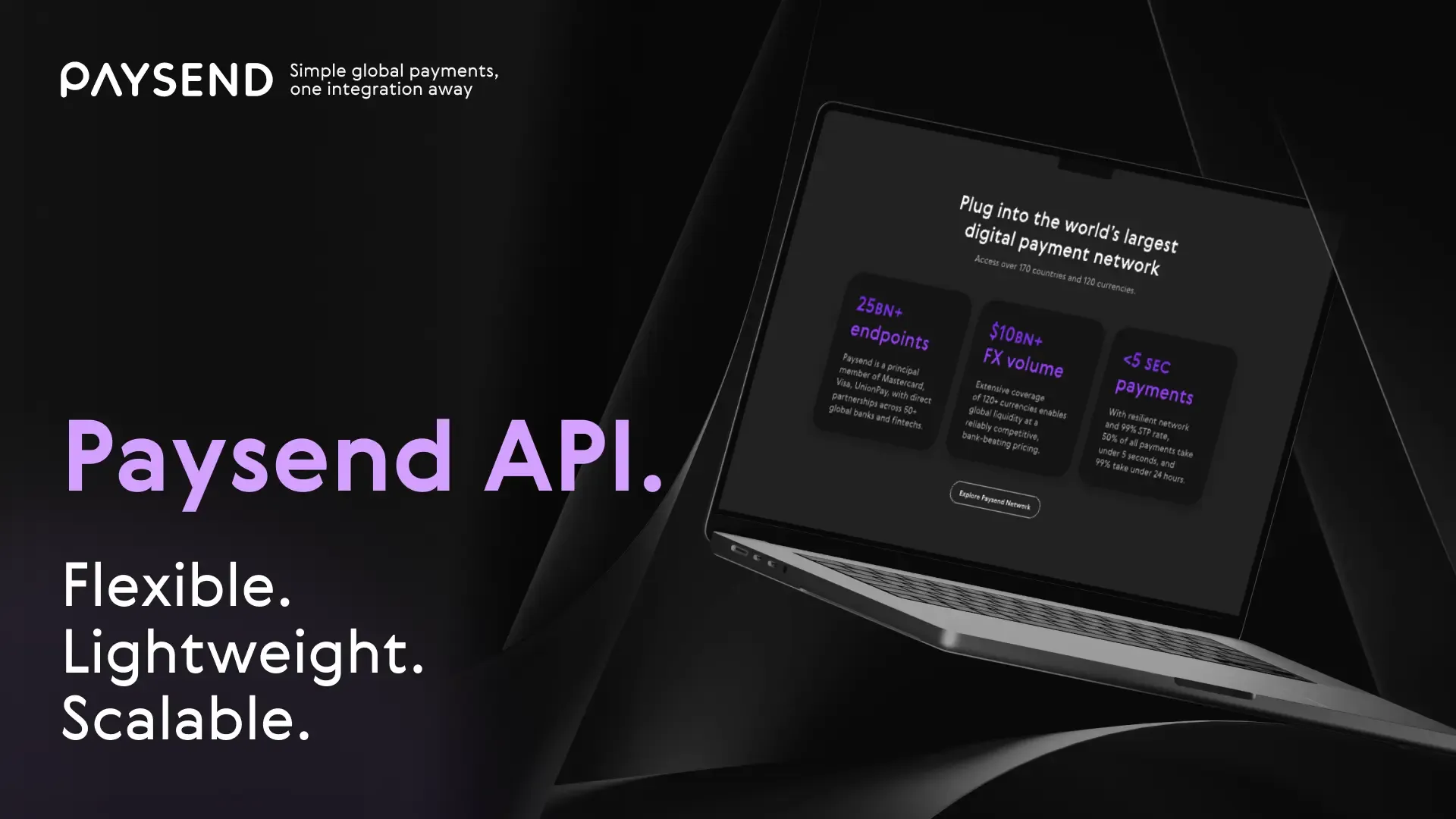

Cross-border money movement has evolved, and institutions now need infrastructure that can scale securely, integrate easily, and deliver value in real time. The Paysend Enterprise API provides that foundation, connecting licensed institutions, fintechs, payment facilitators, and platforms to a global payout network that reaches over 100 countries and supports more than 80 currencies.

Built as part of Paysend’s mission to build the world’s largest digital payment network, the Enterprise API helps partners break barriers in international payments. It allows them to move money with transparency, speed, and control, addressing the main pain points in cross-border transfer: fragmented systems, regulatory complexity, and slow delivery times.