Pensando en el futuro.

Lee los últimos artículos de Paysend

Not long ago, sending money abroad meant standing in line, filling out forms, and hoping your recipient could collect the cash before the office closed. For decades, this was the reality of traditional money transfers, long waits, limited hours, and high fees.

Today, digital-first services like Paysend have changed that story completely. Money now moves in seconds, anytime and anywhere. This evolution isn’t just about technology; it’s about breaking barriers and addressing the main pain points in cross-border money transfer.

Every fall, families in Canada and the United States gather to share meals, gratitude, and togetherness. But did you know that the Canadian and American Thanksgiving holidays are celebrated at different times of year — and with different traditions? Whether you’re Canadian, American, or simply curious, here’s everything you need to know about what sets these two holidays apart.

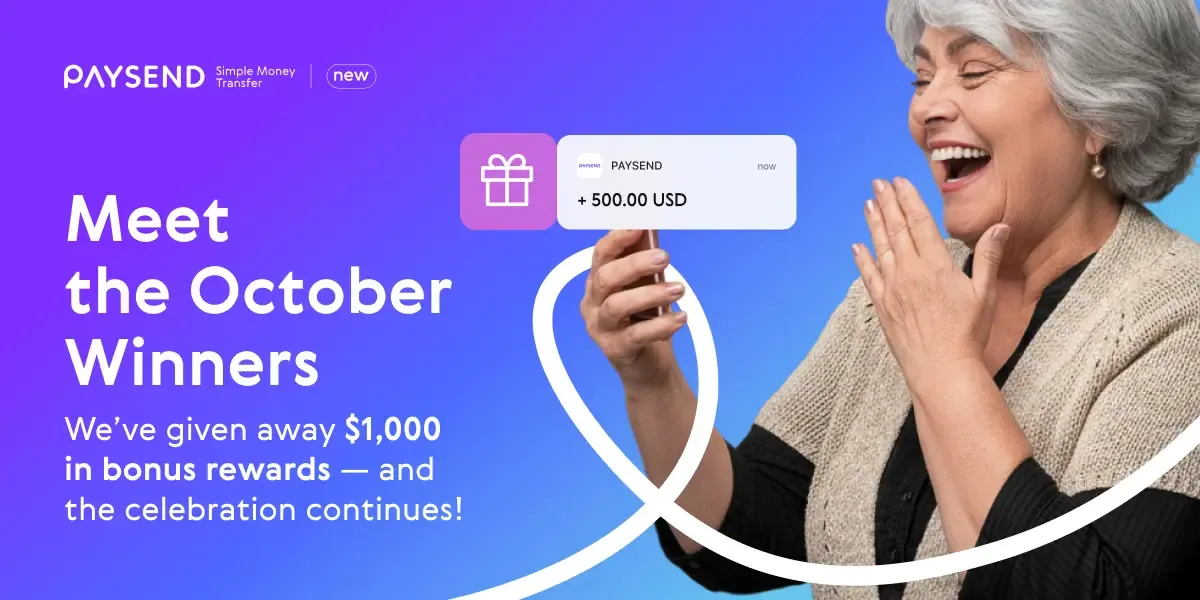

A huge thank-you to everyone who took part in our October Giveaway!

We’ve officially drawn our three lucky winners — each receiving a Paysend Bonus straight into their account.

By Jairo Riveros, Managing Director for the Americas, Paysend

I’m often asked: “How do you seem to know everyone?” or “How do you keep so many relationships active?”

The truth is, I don’t treat networking as a numbers game. For me, it’s not about collecting contacts — it’s about nurturing relationships, staying genuinely curious, and serving as a connector.